As an increasing amount of transactions are being done online in today’s world, more solutions are being implemented to help process payment. There is competition between online payment providers, and their numbers can be confusing. In this article created by our team at wpDataTables, we will take a look at two popular options, Stripe vs Braintree, and compare which may be better for you.

Both Stripe and Braintree are PSPs that help online businesses and provide them with the tools needed to receive or process payments. Both Stripe and Braintree offer companies the financial might to get transactions accomplished without asking store owners to reinvent the system.

What makes Braintree different from Stripe is that it issues merchants their accounts, whereas Stripe is a third-party processor that aggregates payments. This means Braintree offers more stability compared to Stripe. Braintree charges no fee for its tools besides the flat-rate processing, while Stripe charges small fees for the use of their services.

Although the comparison between Stripe and Braintree makes it seem like there may not be much to consider, as both companies provide the same essential services, and there are many smaller factors that need to be considered before we choose one of the above. Let’s explore more about both Braintree and Stripe.

Table of Contents

Stripe vs Braintree, the products and services

The largest similarity between the two is that users can pay online using a variety of different ways with both Braintree and Stripe. They are quite even in terms of products and services. More details include:

- Stripe and Braintree accept every type of credit and debit card like Visa, MasterCard, American Express, Diners Club and Discover.

- Both allow the use of Apple Pay and Android Pay.

- Both companies offer recurring billing.

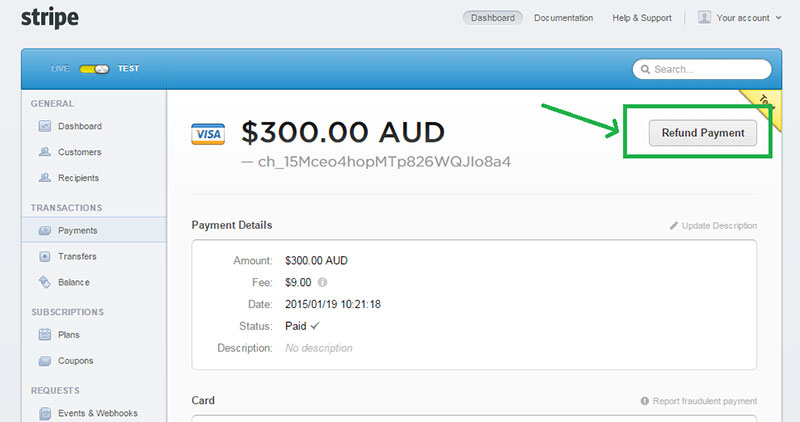

- Both companies refund fees if you repay the payment to a customer.

- Payments usually are made into your account in one to two business days.

Stripe allows you to take payments through AliPay, while Braintree does not. On a similar note, Braintree allows Venmo and PayPal, whereas Stripe does not.

When comparing Stripe and Braintree, we see that one advantage of Stripe is that it works using AliPay. Alipay is a Chinese payment platform, so if you have plans regarding the Chinese market, then for sure, Stripe is going to suit your eCommerce website. It also accepts Automated Clearing House (ACH) payments, which are direct charges to bank accounts, that is not available from Braintree.

Braintree supports merchants in more than 45 countries. Merchants can reach customers in the entire world with support for over 130 currencies. One of the biggest drawbacks is Braintree PayPal integration. As Braintree is a PayPal owned company, it makes a lot of sense that the alliance between the two can be seamless.

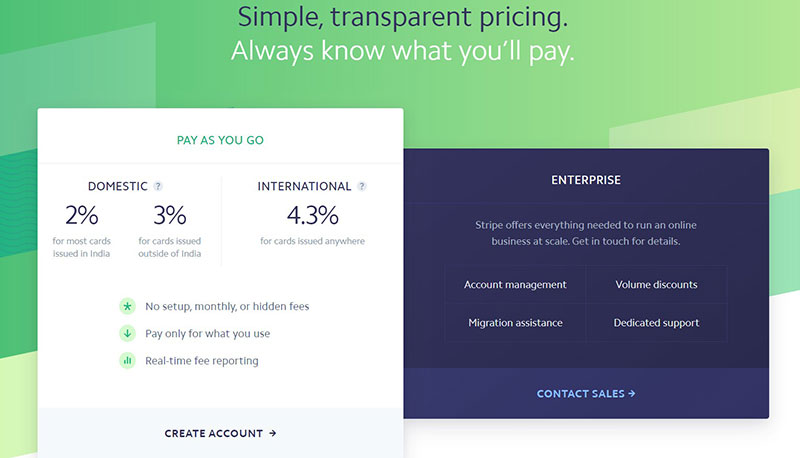

Rates and Fees

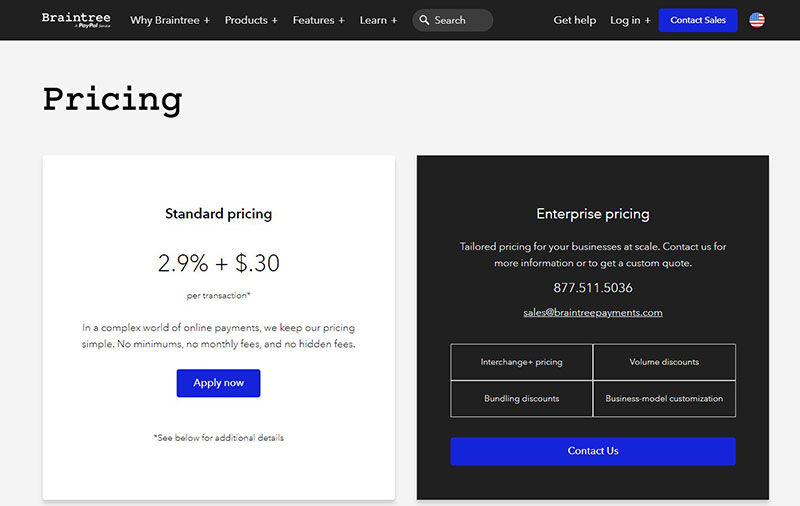

Any responsible business owner will want to know about the cost when they are looking for a payment gateway. When we compare Stripe and Braintree, it is essentially a tie. The Braintree fees do not differ much, and they accept both credit and debit cards. Both offer a flat-rate pricing model. Their flat fee is 2.9 % of any transaction plus an additional 30 cents per transaction. Explained this looks like:

100 $30 charges a month ($3,000) = $117 in fees

Stripe offers a great user experience for its clients, however, the platform is more expensive compared to Braintree. The biggest difference is that Braintree offers the flat-free pricing on their services without any fees to use their platform or analytics tools.

The platform also comes without minimum fees or recurring monthly fees that make it an alluring choice for small businesses that sometimes will not reach certain transactions every month.

Supporting Platform

Marketplace payment platforms take care of payment processing and security. The end goal is the splitting of the money between the seller and the marketplace owner.

Stripe Connect works by letting Stripe users connect to the Stripe marketplace account. Once they are connected, the API can begin the process of payments from buyers and transfer proceeds to sellers. The seller becomes the merchant of record, and the marketplace owner can have their application fee for each of the transactions that take place. The price then gets registered as a payment between the seller and the marketplace owner (together with the commission fee from the sale).

Braintree Marketplace functions by letting the marketplace owner manage and connect to other Braintree Marketplace accounts. When a seller account is connected, the API can be used to process payments from buyers and automatically transfer proceeds to the seller.

The seller is going to keep the records, and the marketplace owner can set the service fee for each transaction. The API that Braintree payment gateway offers is very well built. It is also easy to integrate.

Stripe and Braintree are quite similar in this aspect. They are built using APIs that work on all primary programming languages like PHP, Python, Ruby, and Node.js. These APIs have been implemented correctly, and they are accommodating.

Disputes and Refunds

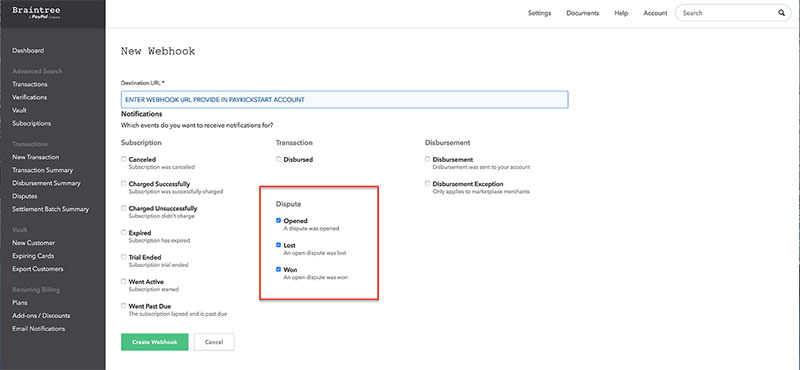

Sometimes, shoppers dispute charges, and there needs to be a solution for them. What is different is how the chargeback management is being done. Both Stripe and Braintree offer guides on how to write APIs that show your innocence. They are also useful to submit evidence and responses classically through the dashboard.

Braintree helps merchants to submit evidence and responses on their dashboard. The account setup is going to influence how the sending of documents is done and what info should be provided.

Both Stripe and Braintree help you handle chargeback transactions, and they will both refund the disputed amount and charge you $15 for the sale. These fees are more collateral for the platforms. Card networks and issuing banks are the ones that usually set the prices. This is why it is normal that merchants pay fees when they are responsible for the chargeback.

However, if the merchant loses, both Stripe and Braintree would keep their respective fees. The issuing bank is going to hand over the disputed debit or credit amount back to the cardholder.

Customer Service

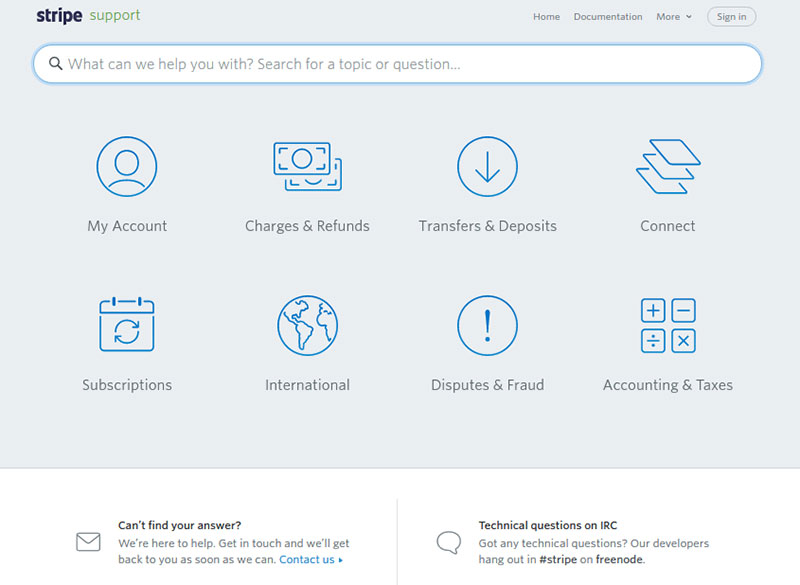

Stripe and Braintree are quite different in this regard. Stripe does not offer any sort of live support, and instead relies on email communication. This is not particularly helpful when you cannot accept payments and need a quick answer. However, Stripe has an IRC channel where developers can help you with different problems.

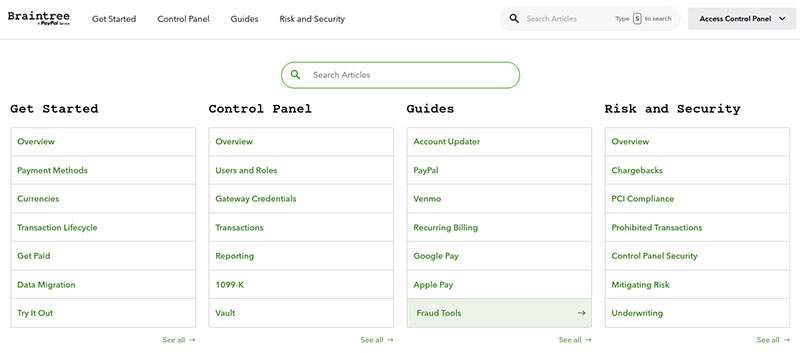

Braintree has excellent customer service and responds promptly to requests and concerns via email. Aside from phone and email communication, Braintree also has a detailed FAQ that you can check.

Security

These two companies can protect all the transactions that you engage in. They have a sandbox that protects devices from failures or software vulnerabilities. Stripe revolutionized online payments with the library that promotes secure development practices. Users can use their credit card, and the data goes to the secure vault of Stripe. This allows you to be PCI compliant.

Braintree’s security is comparable to Stripe. Fraud protection includes 3D Secure and advanced, anti-scam options from Kount. You can customize the parameters to decline transactions based on specific red flags automatically. Just remember that the service is not always compatible with shopping cart integrations.

FAQ on Stripe vs Braintree

Which is easier for a beginner: Stripe or Braintree?

Man, I remember when I was diving into this for the first time. Look, when you’re a newbie, Stripe’s interface might seem a bit more intuitive. But honestly, Braintree ain’t too shabby either.

It boils down to your personal preferences. Just play around with their developer tools for a bit and see which vibe you dig more. Some folks find one easier over the other, but both are solid choices for online transactions.

What’s the deal with transaction fees?

Ah, the age-old question about moolah. So, transaction fees can make or break it for some businesses. Both Stripe and Braintree have competitive rates, but they can vary based on volume, region, and additional services.

It’s kinda like shopping for jeans: you gotta check the fit, style, and price. Oh, and always keep an eye out for those sneaky extra fees, especially with cross-border transactions.

Do both platforms support mobile payments?

Yep, in this day and age, if you aren’t on the mobile game, you’re missing out big time. Stripe and Braintree both allow mobile payments.

They have smooth APIs that gel well with mobile apps. If you’re setting up a mobile shop, both of these big guns got you covered. It’s about giving your customers that slick checkout experience, you know?

Are they both good with fraud protection?

Trust me, nobody wants to mess with fraud. It’s like that unwanted guest at your BBQ. Both platforms take fraud protection seriously.

They use tools and mechanisms like 3D Secure to help safeguard your transactions. That said, always do your homework and maybe even consider third-party services if you’re super concerned about security.

Which one integrates better with e-commerce platforms?

Alright, so, when it comes to e-commerce payment solutions, both Stripe and Braintree can jive with many platforms. Think of platforms like Shopify or WooCommerce.

However, the ease of payment integration might vary. Sometimes, one might be a bit smoother with certain platforms, but generally, they’re both pretty tight in this arena.

How do the developer tools compare?

Oh man, if you’re a code whiz, this is your jam. Developer tools are essential for customization. Both Stripe and Braintree flex their muscles here.

They offer rich sets of tools and APIs to play around with. But again, like I said earlier, you might prefer the vibe of one over the other. Get your hands dirty, experiment a bit, and pick your poison.

Currency conversion: who’s got the edge?

Traveling the digital world, eh? Both Stripe and Braintree support a bunch of currencies.

So, if you’re selling to international customers, these platforms make currency conversion a breeze. Keep an eye on the rates though. Sometimes there are fees associated with cross-border transactions, and nobody likes hidden surprises.

Which has better customer support?

Okay, let’s be real. Even the best of us hit a wall sometimes. Customer support can be a deal-breaker. In my experience, both platforms offer decent support.

However, response times and the depth of help can vary. It’s like ordering pizza; sometimes you get the extra cheese, sometimes you don’t. Dive into forums, ask around, and get a feel for which platform’s customer support vibe you’re feeling more.

ACH payments: do they both support it?

You’re diving deep, I see! So, yes, both Stripe and Braintree support ACH payments.

If you’re into bank transfers and all that jazz, both platforms can be your pals. Just check out their documentation, and you’ll find all the nitty-gritty details.

What about subscription billing?

Subscription models are the rage now, huh? Both Stripe and Braintree can handle subscription billing with flair.

If you’re into that recurring revenue model (who isn’t?), either of these platforms can be your wingman. Just set it up, sit back, and watch the magic happen. Remember to keep your customers in the loop with clear invoices and transaction details. It’s all about that transparent checkout experience.

Ending thoughts on Stripe vs Braintree

In conclusion, choosing a winner between Stripe and Braintree is not as obvious as it would initially seem. If you still cannot decide, you can try using them both, which will give you a better look at how they can fit your needs. If you plan to process mainly international payments, Stripe may be a better option. However, if you plan to process mainly domestic payments, Braintree will likely work better for you.

If you enjoyed reading this article about Stripe vs Braintree, you should read these as well:

- Blogger vs WordPress: Why One is Better than the Other

- WordPress Vs Wix: Key differences you should take into consideration

- Joomla vs WordPress: An in-depth Comparison