Financial data visualization is crucial for understanding complex datasets quickly and intuitively. It’s not just about creating pretty charts; it’s about transforming raw financial metrics into actionable insights. Imagine utilizing powerful tools like Tableau, Power BI, or Excel to generate interactive dashboards and financial graphs that depict everything from stock prices to revenue analysis.

By engaging with this article, you’ll unlock the essentials of financial data visualization, learn the best data visualization techniques, and understand the significance of representing data through candlestick charts, heatmaps, and more.

Discover how data analytics and predictive analytics can drive smarter financial decisions, and explore the impact of advanced visualization software like D3.js and Plotly.

You’ll also get insights into financial performance metrics, market trends, and the importance of data accuracy and integration.

Table of Contents

What is financial data visualization?

Financial data visualization is the process of converting complex financial data into visual formats like charts, graphs, and dashboards. Utilizing tools such as Tableau, Power BI, and Excel, it enables quick, intuitive understanding of financial metrics, trends, and patterns, aiding in data-driven decision-making and comprehensive financial analysis.

Key Components of Financial Data Visualization

Making a masterpiece of financial data visualization is a bit like cooking a fancy dish. You need the right ingredients, the right tools, and a sprinkle of creativity.

Data Quality and Management

Imagine trying to bake a cake with rotten eggs. Doesn’t matter how good your recipe is, right? The same applies here. The first, and most crucial ingredient for financial data visualization, is good quality data.

- You’ll need complete and accurate data. If your data is full of gaps or errors, your visualization is going to be misleading at best, damaging at worst.

- Then, there’s the aspect of relevance. Are you using the right data to answer your questions? Think about it like this – you wouldn’t use a temperature map to track migration patterns, would you?

- Lastly, we have timeliness. Outdated data is just about as useful as yesterday’s news. For financial data visualization to be truly powerful, it has to reflect the current reality.

Visualization Techniques and Tools

You need the right tool for the job.

There are a lot of financial data visualization tools out there that we previously covered.

Then, there’s the technique itself. Bar chart? Line graph? Heat map? Each of these tells a different story, highlights different aspects of your data. Your job is to pick the one that tells your story best.

Interactivity and Real-time Updates

With interactivity, your audience can drill down, explore, engage with your data. It’s not just a presentation anymore; it’s a conversation.

And with real-time updates, your financial data visualization can reflect the pulse of your business, the heartbeat of the market.

Your beautiful data deserves to be online

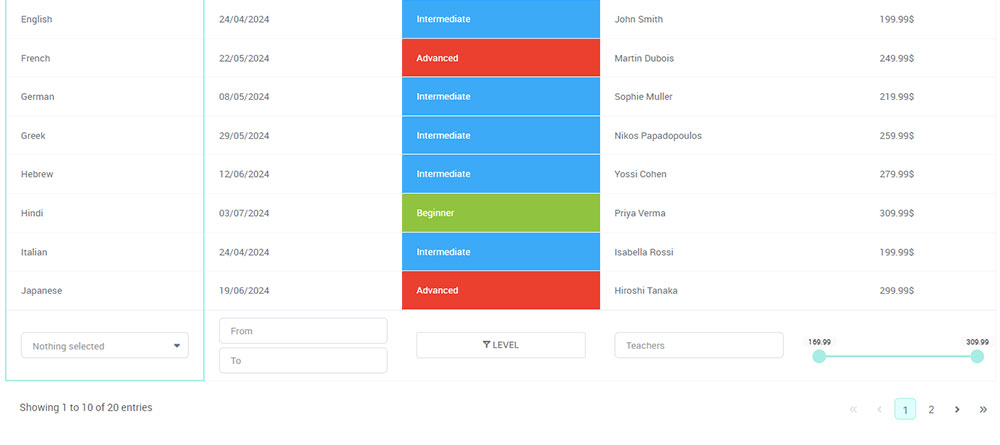

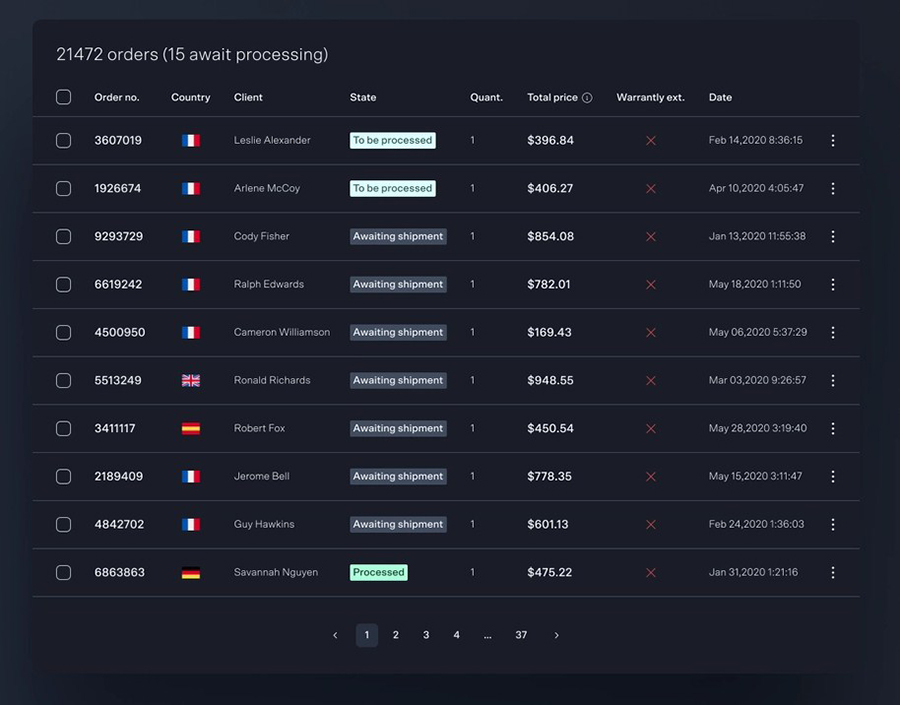

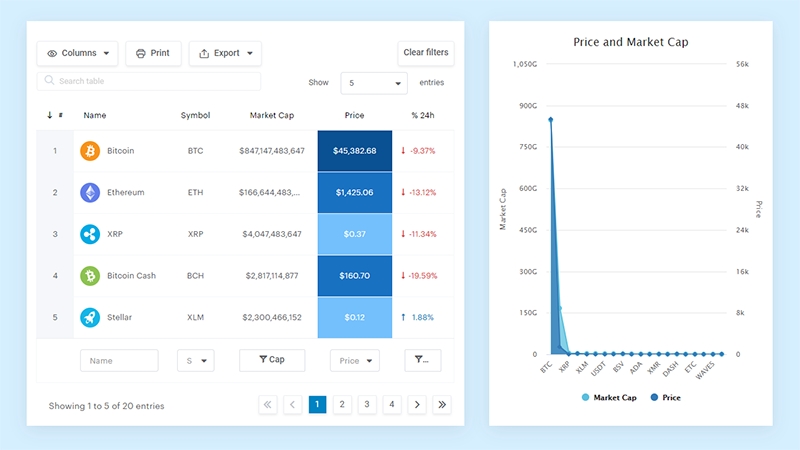

wpDataTables can make it that way. There’s a good reason why it’s the #1 WordPress plugin for creating responsive tables and charts.

And it’s really easy to do something like this:

- You provide the table data

- Configure and customize it

- Publish it in a post or page

And it’s not just pretty, but also practical. You can make large tables with up to millions of rows, or you can use advanced filters and search, or you can go wild and make it editable.

“Yeah, but I just like Excel too much and there’s nothing like that on websites”. Yeah, there is. You can use conditional formatting like in Excel or Google Sheets.

Did I tell you you can create charts too with your data? And that’s only a small part. There are lots of other features for you.

Applications of Financial Data Visualization

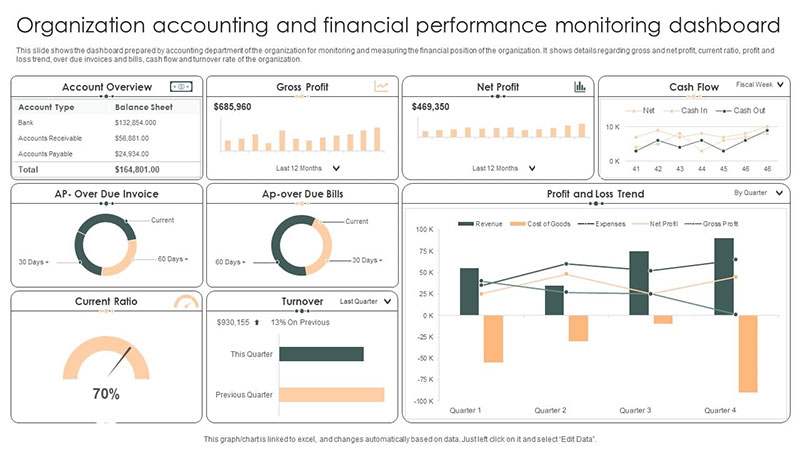

Financial Performance Monitoring

Financial data visualization allows us to monitor the financial health of our business in real-time. It helps us track KPIs like sales revenue, net profit, and cash flow.

And the best part? You can do it too if you have a good financial data tool on your hand.

Financial Forecasting and Budgeting

Here’s the thing about the future – it’s uncertain. But with financial data visualization, we can at least get a glimpse of what’s to come.

By visualizing historical data, we can spot trends, make predictions, and plan accordingly. It’s like having a crystal ball, but grounded in data.

It helps us allocate resources more effectively, identify potential risks, and seize opportunities. It takes the guesswork out of financial planning and brings in informed decision-making.

Risk Management and Compliance

Nobody likes to talk about risk, right?

It’s scary, it’s uncertain, it’s… risky. But guess what? Financial data visualization can make it a whole lot easier.

By visualizing our risk data, we can spot patterns, identify potential hazards, and take preventive measures.

Financial Reporting and Communication

You’ve probably read a financial report by now.

Rows and rows of numbers, jargon that could put a lawyer to sleep, and lots of footnotes.

But what if we could turn that boring report into a dynamic, interactive, visual story? That’s what financial data visualization like wpDataTables can do.

Best Practices in Financial Data Visualization

Alright, so we’ve learned how to create financial data visualizations and seen some ways they can be applied.

When it comes to picking the right visualization, context is king.

Are you comparing values? Maybe a bar chart is the way to go. Want to show a trend over time? Perhaps a line graph is your friend.

Remember, the goal is to communicate information effectively, not to create a piece of abstract art. So, choose a visualization that serves your purpose and communicates your message clearly.

Making Visualizations User-friendly and Accessible

Make it as user-friendly as possible.

Use clear, concise labels. Choose colors wisely.

Don’t overload it with information. And consider your audience’s perspective. What’s obvious to you might not be obvious to them.

And let’s not forget about accessibility. Consider those with visual impairments. Use high-contrast colors, provide text alternatives, make your visualization scalable. Inclusivity isn’t just a buzzword; it’s a necessity.

FAQ on Financial Data Visualization

Why is financial data visualization important?

Financial data visualization is crucial because it simplifies the interpretation of complex data, making it easier to spot trends, patterns, and outliers. This is essential for making informed decisions fast. Employing interactive dashboards and visual analytics aids in efficient business intelligence, comprehensive financial analysis, and strategic planning.

Which tools are commonly used for financial data visualization?

Popular tools include Tableau, Power BI, Excel, D3.js, and Plotly. These tools offer robust features for creating interactive visualizations, financial dashboards, and other data representation formats, which help in insightful data analysis and decision-making processes.

What are the key benefits of financial data visualization?

Key benefits include improved clarity and understanding of financial data, enhanced decision-making, and quicker identification of trends and anomalies. Tools like Tableau provide real-time insights, facilitate data-driven decision-making, and make complex financial metrics more comprehensible through visual analytics.

How does financial data visualization improve decision-making?

By converting large volumes of data into visual formats, it enables faster and more accurate analysis. It highlights critical financial metrics and trends with historical data, allowing investors and analysts to make timely, informed decisions. Tools like Power BI and QlikView support this process with real-time data insights.

What types of charts are used in financial data visualization?

Common charts include line charts, bar charts, candlestick charts, heatmaps, and scatter plots. Each type of chart is used to represent different aspects of financial performance. For instance, candlestick charts are often used in stock market analysis to visualize time series data.

What are some challenges in financial data visualization?

Challenges include ensuring data accuracy, managing large datasets, and choosing the right type of visuals. Using incorrect visualization techniques can lead to misinterpretation. Advanced tools like Python and R can help overcome these by providing more precise and versatile visualization options.

How does financial data visualization aid in risk assessment?

By visualizing risk factors and their potential impact, financial data visualization aids in risk identification and mitigation. Risk assessment visuals can highlight key risk indicators and trends, allowing for proactive measures. Using tools like Tableau and Power BI makes this process more efficient and precise.

What are some best practices in financial data visualization?

Best practices include choosing appropriate charts, maintaining data accuracy, and focusing on clarity. It’s essential to use interactive dashboards for real-time insights and avoid clutter. Employ structured data formats and tools like Google Data Studio or Looker for comprehensive data integration and visualization.

Can financial data visualization be used for predictive analytics?

Absolutely. Financial data visualization can leverage predictive analytics to forecast future trends and performance. By using historical and real-time data, tools like R and Python enable advanced predictive modeling, helping organizations to anticipate market movements and make proactive decisions.

Conclusion

Understanding what is financial data visualization is essential for anyone involved in data-driven decision making. This method converts complex financial information into digestible visuals such as financial graphs, interactive dashboards, and heatmaps. Essential tools like Tableau, Power BI, and Excel are commonly used to craft these visuals, facilitating a more intuitive understanding of complex data.

By leveraging financial data visualization, you can expedite your analysis of key metrics and trends. This not only enhances data accuracy but also supports risk assessment and predictive analytics. Quickly identify trends, spot outliers, and make informed decisions faster. High-quality visuals also improve stakeholder communication, making it easier to convey intricate information effectively.

In summary, mastering financial data visualization equips you with the skills to transform data into actionable insights. This enhances your ability to navigate the financial landscape efficiently, making well-informed decisions that drive success. Employing advanced visualization techniques and software prepares you to tackle any financial data challenge with confidence.

If you enjoyed reading this article about financial data visualization, you should read these as well:

- The Types of Comparison Charts You Can Use on Websites

- The Different Types of Charts and Graphs You Might Use

- How to Embed a Chart on a Website Easily With wpDataTables