Candlestick charts are essential for anyone serious about trading, providing crucial insights into market trends and price action. With origins in Japanese candlesticks, these charts have become a staple for technical analysis in financial markets. They reveal patterns and signals that can guide traders in making informed decisions, whether you’re involved in stock market trading, Forex trading, or crypto trading.

By the end of this article, you’ll have a comprehensive understanding of candlestick patterns like Doji, Hammer, and Engulfing, and learn how to integrate them into your trading strategies. We’ll explore how these charts interact with other technical indicators like moving averages, Bollinger Bands, and the Relative Strength Index (RSI). Understanding these concepts can elevate your trading game, providing insights into bullish and bearish trends, market sentiment, and potential reversals.

Prepare to delve into the key aspects of candlestick chart analysis, including identifying support and resistance levels, interpreting volume analysis, and utilizing charting software like TradingView and MetaTrader.

Table of contents

- What Is A Candlestick Chart?

- Candlestick Chart Example

- When To Use A Candlestick Chart

- How To Read A Candlestick Chart

- Types Of Candlestick Charts

- How To Make A Candlestick Chart In WordPress

- How To Make A Candlestick Chart In Excel

- How To Make A Candlestick Chart In Google Sheets

Table of Contents

What Is A Candlestick Chart?

A candlestick chart is a graphical representation of price movements in financial markets, using candles to show the open, high, low, and close values for specific time periods, revealing trends and patterns to traders.

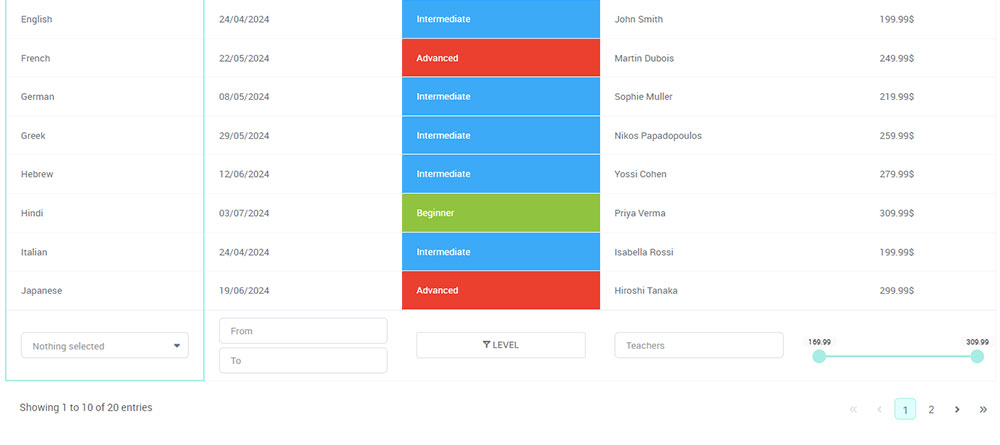

Candlestick Chart Example

Chart created with wpDataTables

When To Use A Candlestick Chart

Picture this – you’re staring at a screen full of numbers, a financial whirlwind.

That’s where a candlestick chart jumps in. It’s like that person who can walk into a messy room and tell you exactly where your keys are.

When do you roll out the candlestick chart?

Take a pause. Think of the moment you’re about to unpack market behaviors or that instant when a stock’s heartbeat, its ups and downs, matter the most.

- Analyzing Stock Movements: Candlestick charts give life to historical price actions, transforming them into simple visuals. A red and green dance of bars, whispering whether the market’s feeling bullish or bearing down hard.

- Spotting Market Trends: Eyes on the screen, noticing a pattern? That’s your candlestick chart, turning the abstract into something you can almost touch – like spotting a familiar face in a crowded street.

- Technical Analysis Deep Dive: Ready to go Sherlock on your stocks? Combining candlesticks with trend lines and Bollinger Bands, and it’s the perfect storm for seeing through market illusions.

- Timing the Trade: Precision, my friend, that’s the game. A few candlestick patterns screaming ‘buy’ or ‘sell’? Yeah, you’ll need those before you jump into the market’s deep end.

- Digging Into Details: Short-term, long-term – doesn’t matter. Candlestick charts are those bins on the shelves, storing all the info from intraday trading to timeframe analysis, accessible in a blink.

How To Read A Candlestick Chart

Reading a candlestick chart is all about catching the visual cues.

- Watch the Body: The rectangle in the middle? That’s the body. It tells you where the price started and stopped within the timeframe. If it closed higher than it opened, it’s often colored green or white; dropped down, it’s red or black.

- Size Up the Wicks: Those thin lines stretching out? They’re the wicks or shadows. They’re like antennas picking up signals – the highest and lowest points the price hit before coming back.

- Get the Color Code: Green means go – prices moved up. Red screams stop, prices went down. It’s a traffic light for the market direction.

- Pattern Party: Single candle or a group, they’re all whispering secrets. A Doji, the one with a tiny body, is mumbling about indecision. Marubozu doesn’t mess around – all body, no wick, it’s yelling about strong buying or selling.

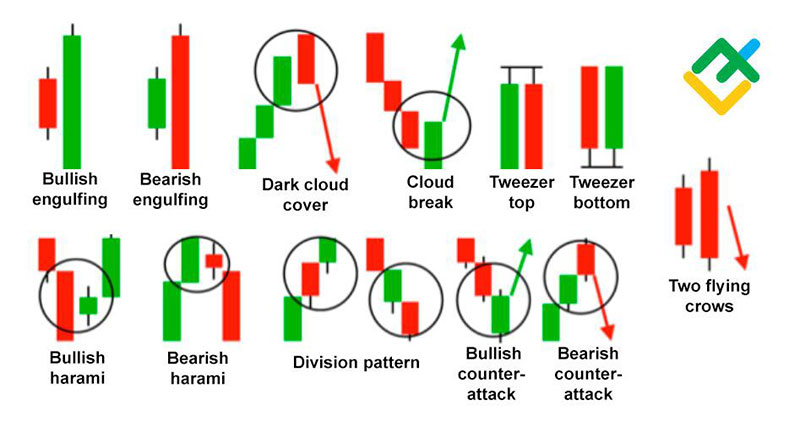

Types Of Candlestick Charts

Think of these as the different vibes of candlestick charts. They’re not all cast from the same mold. So, let’s break it down:

Single Candle Patterns:

- You’ve got your Dojis, just hanging there, lines with a tiny body, signaling “Hey, we’re kinda indecisive here.”

- Then, those Marubozus, full-bodied like a confident stance, no wick, pure price drive in one direction.

Dual Candle Patterns:

- Talk about drama with Engulfing – one color swallows the other, signaling a potential flip in power.

- Harami is more like a cozy nest, one candle sitting snugly within the other, tipping you off to a possible slowdown.

Complex Patterns:

- These are the storytellers, groups of candles that get together like a series. Morning Stars, Evening Stars – they’re the novellas in charts hinting at bigger plots.

- Three Black Crows or Three White Soldiers, they march in a line announcing a stronger move.

How To Make A Candlestick Chart In WordPress

To create a candlestick chart in WordPress using wpDataTables, follow these general steps:

- Open the WordPress admin panel and navigate to wpDataTables -> Create a Chart.

- Choose a chart engine (like Google Charts, Highcharts, Chart.js, or ApexCharts) and select the candlestick chart type.

- Define the data source by selecting a wpDataTable.

- Specify the data range for the chart, including columns and rows from the table.

- Adjust chart formatting options and preview your chart.

- Save the chart and use the generated shortcode to insert the chart into your WordPress post or page.

How To Make A Candlestick Chart In Excel

To make a candlestick chart in Excel, you need to follow these steps:

- Enter the data for the stock’s open, high, low, and close prices over a period.

- Highlight all the values in the specified range.

- Go to the Insert tab, select the Waterfall icon, and then choose the Open-High-Low-Close chart type.

- Modify the chart by adding a title and adjusting colors for the ‘up’ and ‘down’ candlesticks.

How To Make A Candlestick Chart In Google Sheets

To create a candlestick chart in Google Sheets, follow these steps:

- Prepare Data: Organize your data in a table with columns for date, open, high, low, and close. Format the date column as plain text and the numerical columns in financial format.

- Select Data: Highlight the entire data range, including headers.

- Insert Chart: Go to the Insert tab and select Chart.

- Choose Chart Type: In the chart editor, select Candlestick chart from the Chart type dropdown menu.

- Customize Chart: Adjust the chart style, colors, and labels for better readability.

FAQ About Candlestick Charts

Why are candlestick patterns important?

Candlestick patterns are essential for identifying potential market movements. Patterns like Doji, Hammer, and Engulfing provide insights into bullish or bearish trends. Recognizing these patterns helps traders make informed decisions and improve their trading strategies, whether in stock markets, Forex, or crypto trading.

How do you read candlestick charts?

Reading candlestick charts involves understanding each candlestick’s body and wicks. The body shows the price range between opening and closing. The wicks signify the highest and lowest prices. By analyzing these components, traders can predict potential reversals, continuations, and overall market sentiment.

What are the most common candlestick patterns?

Common candlestick patterns include Doji, Hammer, Hanging Man, Engulfing, Morning Star, and Evening Star. Each of these patterns signals specific market behaviors, like trend reversals or continuations. Knowing these patterns enhances your ability to make data-driven trading decisions.

How do candlestick charts compare to other chart types?

Candlestick charts offer more detailed information compared to bar or line charts. They provide a comprehensive view of price action within a given period, including open, close, high, and low prices. This granular data makes candlestick charts a preferred choice for in-depth technical analysis.

Can candlestick charts be used for different markets?

Absolutely. Candlestick charts are versatile and used across various financial markets, including stocks, Forex, commodities, and cryptocurrencies. They offer valuable insights regardless of the asset class, making them indispensable for traders looking to understand price action and market behavior.

What tools can help analyze candlestick charts?

Charting software like TradingView and MetaTrader is excellent for analyzing candlestick charts. These tools offer various technical indicators, such as moving averages, Bollinger Bands, and the Relative Strength Index (RSI), to enhance your analysis and improve trading strategy effectiveness.

How do candlestick charts predict market trends?

Candlestick charts predict market trends by showcasing patterns that indicate bullish or bearish movements. Patterns like Doji and Engulfing reveal market sentiment and potential reversals. By studying these charts, traders can anticipate future price actions and position themselves better in the market.

Are there risks in relying on candlestick charts?

Relying solely on candlestick charts carries risks, as they don’t guarantee future performance. Complement them with other technical indicators and robust risk management to minimize potential losses. Remember, no single tool should be your only source of trading decisions.

How do candlestick charts interact with other indicators?

Candlestick charts work synergistically with other technical indicators like moving averages, Bollinger Bands, and RSI. These tools confirm candlestick patterns, providing added layers of analysis. Combining them offers a well-rounded view, enhancing the accuracy of market predictions and trading strategies.

Conclusion

Candlestick charts provide invaluable insights for traders. They offer a detailed look at price action, revealing patterns that drive market sentiment. Understanding these charts can be a game-changer for your trading strategies.

In summary:

- Understanding Candlestick Patterns: Recognize formations like Doji, Hammer, and Engulfing to predict market trends.

- Technical Indicators: Use tools such as moving averages, Bollinger Bands, and RSI to supplement your analysis.

- Market Versatility: Candlestick charts apply to various markets including stocks, Forex, commodities, and cryptocurrencies.

- Charting Tools: Utilize software like TradingView and MetaTrader for comprehensive analysis.

- Risk Management: Combine candlestick analysis with other indicators to manage risk optimally.

Mastering candlestick charts equips you with the skills to make informed trading decisions, enhancing your ability to interpret market behavior. Leverage these insights for a more nuanced approach to trading, ensuring you stay ahead of market trends and make strategic, data-driven decisions.

If you liked this article about candlestick charts, you should check out this article about bar charts.

There are also similar articles discussing pie charts, line charts, bubble charts, and waterfall charts.

And let’s not forget about articles on stacked bar charts, area charts, column charts, and donut charts.