Let’s dive deep into the colorful world of financial charts and graphs. You know, those cool visuals that might seem like mysterious hieroglyphics to some, but are like blockbuster movie trailers to the financially savvy. Yep, we’re unraveling the enigma.

Now, before you think, “Charts? Snooze…” — hold up!

Ever imagined diving into a pool of money, Scrooge McDuck style? Well, understanding these visuals is kinda like getting the map to the treasure.

Ever been to a concert? That crescendo in your favorite song? Charts and graphs have their own rhythm, peaks, and drops. It’s like music for your money.

And you’ve seen those fancy suits in Wall Street movies, right? Guess what they’re staring at on those big screens? Bingo!

So, if you’re ready to decode the beats of financial wizardry, jump in, and let’s make those charts sing!

Table of Contents

Key Financial Charts and Graphs

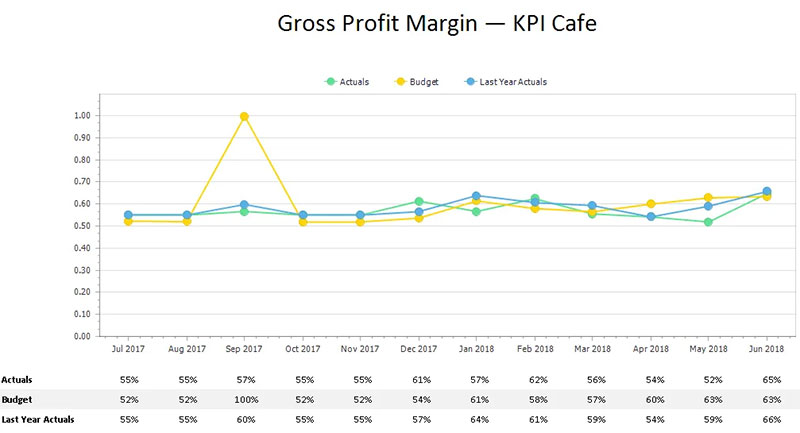

Gross Profit Margin

Definition and importance

So, here’s the tea: Gross Profit Margin is basically the superstar metric that lets businesses know how much money they’re making, minus the direct costs. If you’re selling stuff, it’s a measure of how much profit you’re making on those sales before any other expenses are taken out. Kinda like knowing how much you earned at a gig before you pay for the gas and snacks.

Formula and calculation

The gross profit margin is determined by taking net sales (gross revenues minus any returns, allowances, or discounts) and deducting the cost of goods sold (COGS). This result is then divided by the net revenues and multiplied by 100% to get the gross profit margin percentage.

Visualization techniques

Think pie charts, bar graphs, or even those snazzy line charts. Whatever helps you see the ups and downs and everything in between. These visuals are like the Spotify playlists of financial data – they help set the mood and show the trends.

Net Profit

Definition and significance

Okay, moving on to Net Profit. This is the money left after all expenses. Not just the direct costs like in Gross Profit. So, it’s like checking your bank balance after you’ve paid rent, grabbed coffee, and maybe snagged that sweet new pair of kicks.

Factors affecting net profit

There’s a whole world of stuff that can tweak this number: sales, returns, expenses, the cost of those unexpected things (like when your laptop decides to take a day off). All these factors jive together to form your net profit.

Best graphs for representation

Histograms, waterfall charts, or even heat maps. Imagine them like filters on your fave photo app – each one gives you a different vibe and shows the data in a unique way.

Net Profit Margin

Distinction from Gross Profit Margin

Here’s where folks get tripped up. While Gross Profit Margin is like the money from a gig before gas and snacks, Net Profit Margin is after everything. It’s like the money left in your pocket when the night is over.

Importance of tracking both margins

Now, you might ask, “Why not just focus on one?” Because both tell different stories, dude. Gross gives you the quick feels, while Net goes deep. It’s like knowing both the catchy chorus and the full lyrics of a song.

Visualization tools and techniques

Dashboard widgets, spider-web charts, or even simple column graphs. It’s about picking the visual that vibes with your data and makes those numbers dance.

Aging Accounts Receivables

Importance of tracking unpaid invoices

Ever had someone owe you money? Kinda sucks, right? That’s what unpaid invoices are in the business world. And if you don’t keep an eye on them, it’s like forgetting you lent money to that friend who always “forgets” their wallet.

Impact on liquidity

Here’s the deal: if too many folks owe you money and ain’t paying up, your cash flow gets cramped. It’s like wanting to buy concert tickets but waiting on friends to pay you back first.

Accounts Receivable Turnover Ratio

Now, this is a fancy way of saying, “How often are people paying me back?” It’s your business’s way of checking which buddies are good for paying back that borrowed lunch money.

Key Financial Charts and Graphs

Current Ratio

Definition and significance

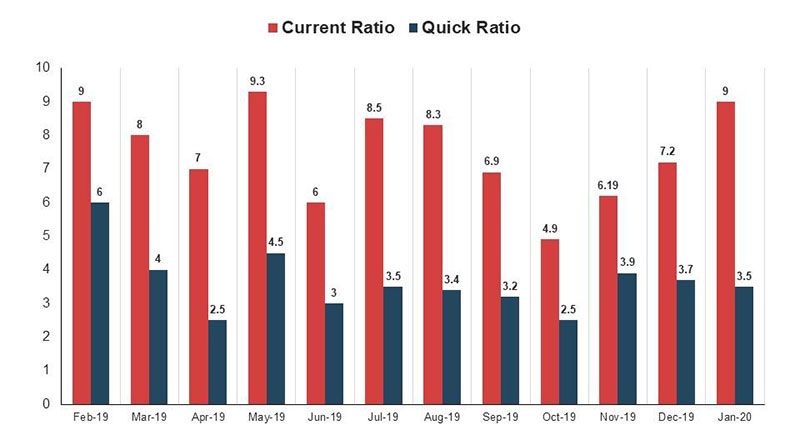

Alright, so imagine this. You’re packing for a beach trip. You’ve got your sunscreen, your shades, and some snacks. The Current Ratio is kinda like asking: “Do I have enough snacks for the entire day?”

In the biz world, it’s about knowing if a company has enough assets to cover its short-term liabilities. It’s the vibe check for a company’s short-term financial health.

Ideal range for businesses

Think of it as the “golden range” for your playlist. You wouldn’t want a playlist that’s all slow jams when you’re trying to party, right? For businesses, this sweet spot is typically between 1.5 and 3. If it’s less than 1, it’s like running low on snacks before noon. Not the best look.

Implications of a low current ratio

Oof, this ain’t good. A low ratio means you might struggle to cover short-term debts. It’s like realizing mid-trip that you forgot your sunscreen at home. Burnt skin and financial burns? Both things you wanna avoid. Trust.

Advanced Financial Charts and Graphs

Wait, what? Yeah, that’s right, we’re diving even deeper. Leveling up, so to speak. Buckle up, because these financial charts and graphs are like the deeper cuts on your favorite artist’s album. They’re niche, they’re detailed, and oh-so-telling.

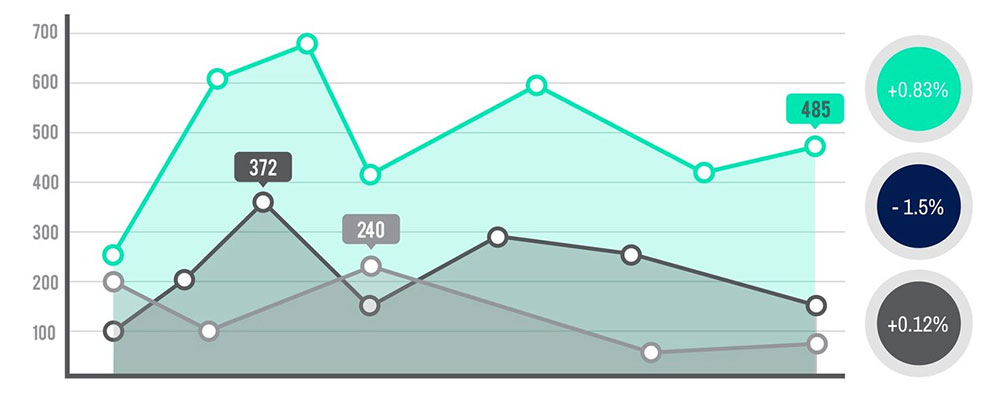

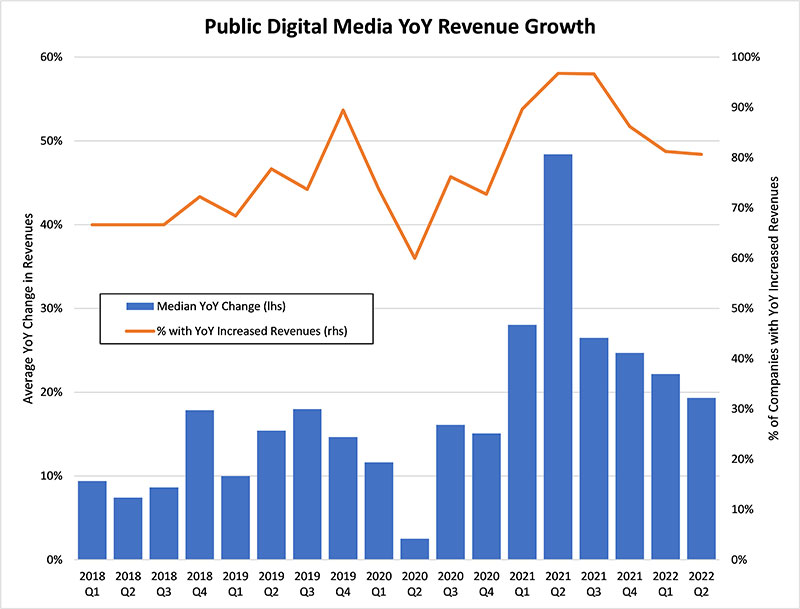

Revenue Growth

Importance in assessing business health

Ever hear of a business that doesn’t care about growing their revenue? Me neither. Revenue Growth is like watching your follower count spike after posting that killer beach pic. It feels good, and it shows the world you’re on the right track.

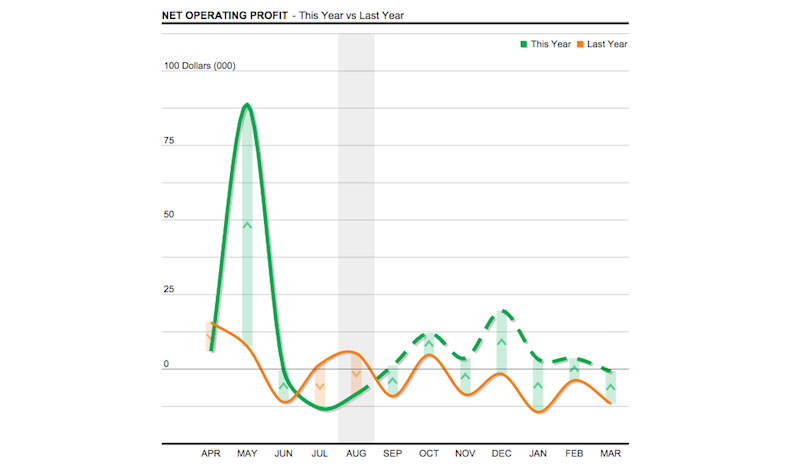

Year-over-year comparison

Time to get nostalgic. Remember how you compared last summer’s photos with this year to see how much you’ve changed (or how much better your photo skills have gotten)? That’s what businesses do with their revenue. They compare this year to last year to get the bigger picture.

Visualization techniques

Radar charts, area graphs, or those wavy line graphs that look like sound waves. The key? Picking what makes the ups, downs, and growth spurts stand out. It’s all about making those figures sing, man.

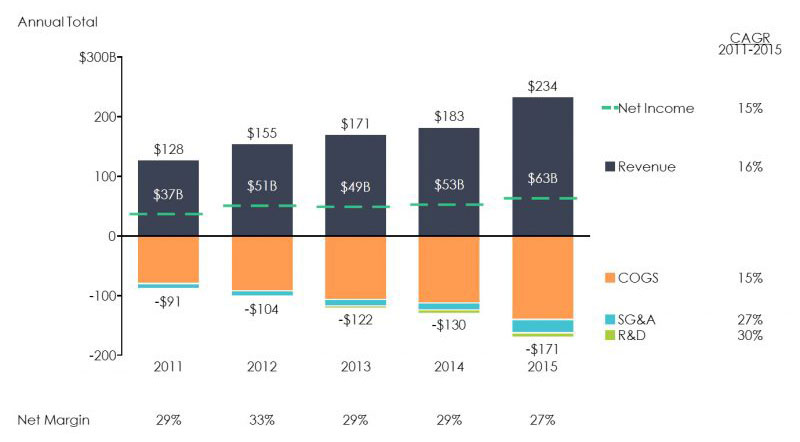

Profit and Loss Statement

Overview and significance

This statement, my friends, is the mixtape of a company’s financial world. It’s the rundown of their hits and misses, the highs (profits) and the lows (losses). It tells a business where their money’s coming from and where it’s jetting off to.

Key components

- Revenues: Think of it as the number of streams on your top track.

- Costs of Goods Sold: Like the cost of renting studio time.

- Operating Expenses: Like your daily coffee runs, and yeah, those add up.

- Profit or Loss: Endgame. Did you make bank, or is it back to the drawing board?

Best graphs for representation

Stacked bar charts, segmented pie charts, or the classic column charts. Just like in a playlist, the right sequence and type can make or break the vibe. So pick something that makes the story clear as day.

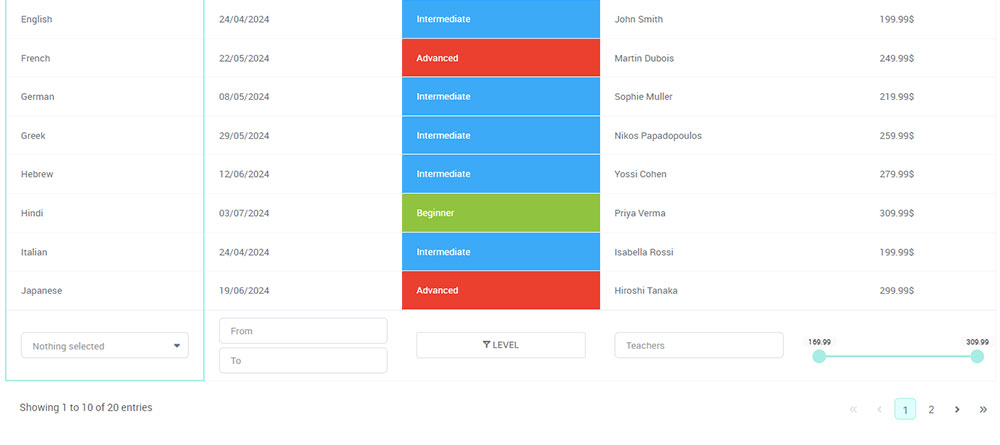

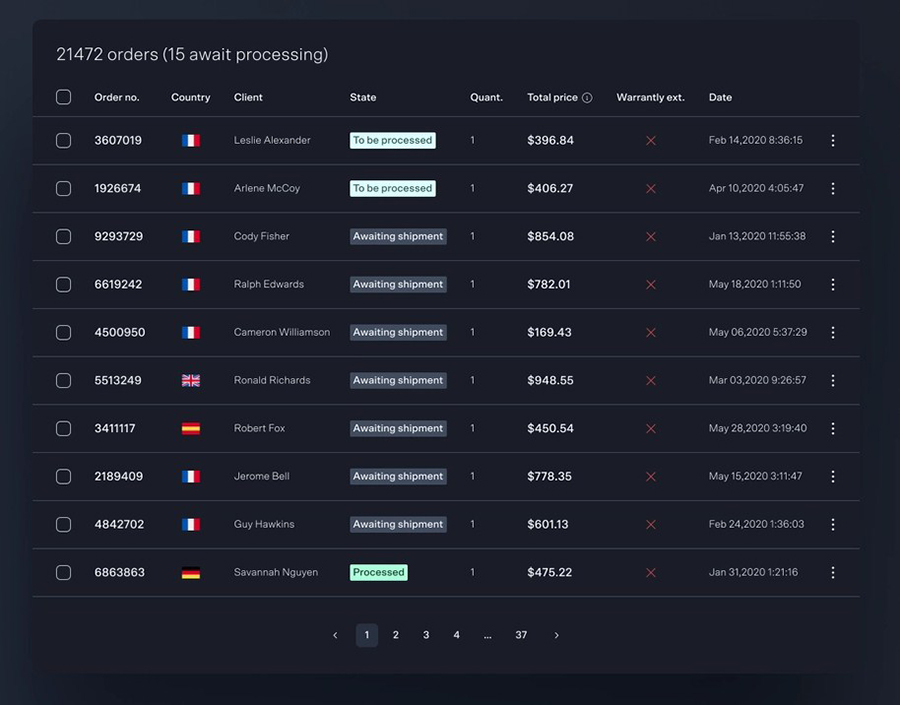

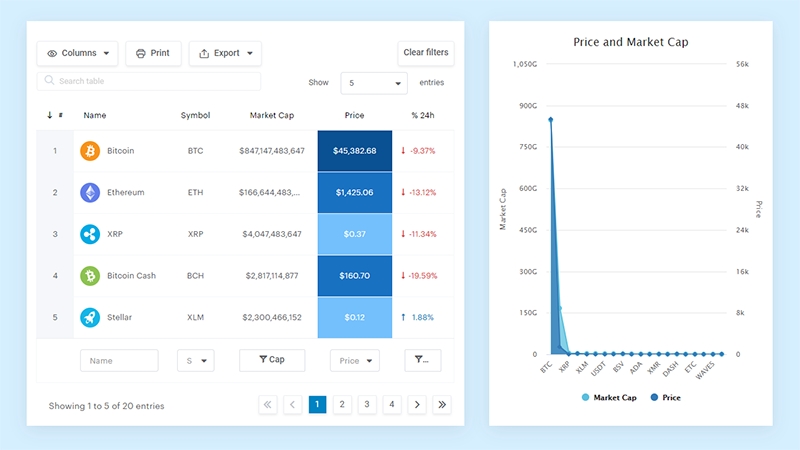

Your beautiful data deserves to be online

wpDataTables can make it that way. There’s a good reason why it’s the #1 WordPress plugin for creating responsive tables and charts.

And it’s really easy to do something like this:

- You provide the table data

- Configure and customize it

- Publish it in a post or page

And it’s not just pretty, but also practical. You can make large tables with up to millions of rows, or you can use advanced filters and search, or you can go wild and make it editable.

“Yeah, but I just like Excel too much and there’s nothing like that on websites”. Yeah, there is. You can use conditional formatting like in Excel or Google Sheets.

Did I tell you you can create charts too with your data? And that’s only a small part. There are lots of other features for you.

Advanced Financial Charts and Graphs

Oh man, time to deep dive! We’re moving from the basic beats to the electric guitar solos of the financial charts and graphs world. Let’s amp up the volume and hit those advanced notes.

Revenue Growth

Alright, let’s jam.

Importance in assessing business health

So, think of Revenue Growth as the speedometer on your favorite car. Faster it goes, the better the thrill. It’s all about watching that number climb. When the revenue rises, it’s like that heart-pounding moment when your post gets tons of likes in seconds.

Year-over-year comparison

Remember looking at your old photos and thinking, “Dang, I’ve come a long way”? That’s the mood here. Businesses check out how they did this year versus last year. And trust me, everyone wants to see growth. It’s like seeing more muscles after weeks at the gym.

Visualization techniques

Alright, think dynamic. Think animated bar charts racing each other, or colorful heat maps. It’s like choosing between indie rock and electric pop—both are good, but one might just resonate more, depending on the data.

Operating Expense Ratio

Definition and importance

Operating Expense Ratio sounds fancy, but picture this: after your mega house party, you’re looking at what’s left of the snacks, the beverages, and that accidental lamp breakage. This ratio tells you how much it costs to run the show, compared to the cash you’re pulling in.

Impact on profitability

If this ratio’s high, warning lights should be flashing. It’s like spending all your cash on party props and leaving nada for the actual party. If a business spends too much on just operating, there might be less left for the fun stuff, like growth or bonuses.

Visualization tools and techniques

3D donut charts, or maybe those cool treemaps. Or, imagine a DJ mixing on the deck, and every beat drop is a data point. Yeah, pick what gets the crowd (or the board) going!

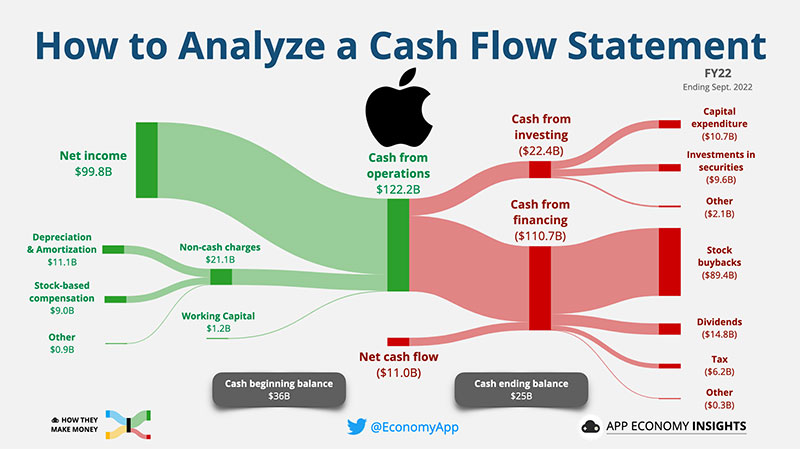

Cash Flow

Money in. Money out. Let’s break it down.

Importance in business operations

Cash flow is the bloodline. Think of it as your phone’s battery. When it’s flowing and charged, you’re all good. But run out? Yeah, panic mode. For businesses, ensuring there’s a steady flow is make or break.

Factors affecting cash flow

There’s the obvious stuff, like sales and purchases. But then there’s the sneaky things, like delayed payments or unexpected expenses. It’s like planning a road trip but forgetting about tolls and snack breaks.

Best graphs for tracking cash flow

Interactive line charts that you can hover over, waterfall charts showing the inflow and outflow, or even scatter plots. Find the beat that makes your financial dance floor light up.

Industry-Specific Financial Metrics

Alright, alright, alright. Time to switch up the beat. Just like you wouldn’t wear beach attire to a snowstorm, every industry’s got its own rhythm. Let’s groove into the specifics of different sectors and their unique financial charts and graphs.

Online Businesses

Hey there, digital nomad.

Cost of customer acquisition

Okay, so imagine throwing a massive online party (livestream, of course). Now, every party-goer you invite costs you a bit. Maybe it’s ads, maybe it’s giveaways. That cost? That’s what we’re talking about. How much you spend to get each new customer clicking on your virtual door.

Website traffic and its significance

Think of this as footfalls in a store, but online. It’s the hustle and bustle of visitors popping into your online space. More traffic? Bigger party. And who doesn’t love that?

E-commerce Businesses

Shopping spree, but make it virtual.

Average cart size

So, you’ve added those sneakers, that cap, and, oh, a new tee. That’s your cart. The more you add, the bigger it gets. For e-commerce peeps, knowing the average size means understanding how much folks typically spend.

Return on advertising spend

Ever thrown cash into a wishing well? This is kinda like that, but for ads. You toss money into advertising and wait to see what you get back in sales. The dream? Spend a dime, make a dollar.

The Role of Financial Dashboards

Switching gears, let’s chat dashboards.

Importance in real-time tracking

Imagine playing a video game without a scoreboard. Meh, right? A dashboard’s like that epic scoreboard, always updating, always letting you know the score. It’s the heartbeat of financial charts and graphs.

Sharing and collaboration features

You know when you discover a killer playlist and just HAVE to share it with your besties? Financial dashboards let businesses do that. Share insights, collaborate on forecasts, and basically keep everyone dancing to the same beat.

Customization and integration capabilities

So, a one-size-fits-all cap? Lame. Custom cap with your favorite band logo? Epic. Dashboards are no different. Customize them, integrate different tools, and make it all about you.

FAQ on Financial Charts and Graphs

What’s the difference between a line chart and a bar chart?

Man, I get this one a lot. So, a line chart connects data points with lines, showing trends over time. Super useful for spotting patterns, like stock prices. On the other hand, a bar chart uses bars to show quantities. They’re cool when you wanna compare stuff side by side. Think about it like comparing sales across different months.

Why do people use candlestick charts in finance?

Oh, the good ol’ candlestick charts! These bad boys are huge in the stock market. Each “candle” shows four things: the opening and closing price, and the highest and lowest price during a period. The colors? They’re not just for show. Green (or white) means prices went up, and red (or black) means they dipped. It’s all about getting a deep dive into price movements.

What do the terms “bullish” and “bearish” mean in a chart?

Ah, the stock market lingo. When we say “bullish”, we’re talking about a positive or upward trend in the chart. It’s like the bull charging forward, full of energy. “Bearish”? That’s the opposite. It suggests a downward trend, kinda like a bear hibernating. It’s the ebb and flow of the market, buddy.

How do moving averages work?

Moving averages, my friend, are the unsung heroes of financial charts. They show the average value of data over a set period. So, you can smooth out those jarring price jumps and get a clearer picture of the trend. There’s simple moving averages (SMA) and the fancier exponential ones (EMA). They can even act as support or resistance levels, if you’re into that technical analysis thing.

What’s a pie chart and when should I use it?

Pie charts, mmm, now I’m hungry. These charts split data into “slices” to show percentages of a whole. Think of it like a pizza divided among your pals. Great for visualizing parts of a whole, like market share. But a word of caution, mate: don’t use them if you have too many slices. It gets messy.

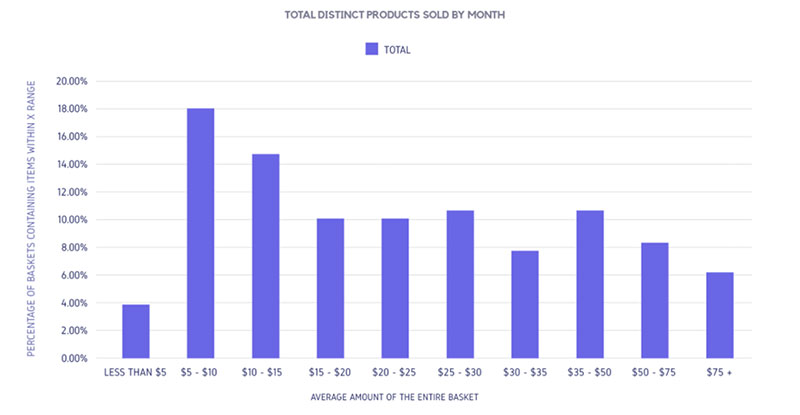

Why are histograms useful?

Histograms, man! These are kinda like bar charts, but they show the distribution of data. Each bar groups numbers into ranges. Want to know how often a certain value pops up? Histogram’s got your back. Perfect for understanding the spread or concentration of your data.

What are trend lines and why are they important?

Trend lines, mate, are like your financial GPS. Drawn on charts, they highlight the general direction of data. Going up? Going down? Sideways? A good trend line will tell ya. They’re key because they help traders predict future price movements. It’s all about spotting opportunities and avoiding pitfalls.

Can you explain volume bars?

Ah, volume bars, the unsung indicators. They’re those vertical bars at the bottom of many stock charts. They show how many shares of a stock were traded during a certain period. High volume? Lots of action. Low volume? Not so much. It’s like the heartbeat of the market – telling you how excited (or bored) traders are.

What do support and resistance levels mean?

Support and resistance levels are the financial world’s magic lines. They represent price levels where a stock seems to either bounce back or reverse its trend. Imagine a trampoline: support is where the stock bounces up, and resistance is where it gets pushed down. They’re all about spotting potential buy or sell opportunities.

What’s the point of a scatter plot?

Last but not least, scatter plots! These plots show individual data points across two axes. They’re all about showing relationships. Ever wondered if two variables move together? A scatter plot will spill the beans. And if you see a bunch of dots forming a line or curve? That means there’s some kind of correlation going on. Knowledge is power, right?

Ending Thoughts on Financial Charts and Graphs

Financial charts and graphs, huh? Man, when I think about them, my mind swirls with colors and lines, each telling its own story of dollars, cents, rises, and falls.

Now, let me break it down for ya:

- Colors: Reds, greens, blues. Not just pretty shades, but these often show us the mood of the market. It’s like mood rings but for money!

- Lines: Ever looked at mountain ranges? Peaks and valleys? That’s kinda what we’re looking at here. Peaks can mean big wins, valleys… well, not so much.

But, you know what?

At the end of the day, these financial charts and graphs? They’re more than just colors and lines. They’re the heartbeats of economies, businesses, and our wallets.

They’re snapshots of where we’ve been and hints of where we’re headed.

So, next time you’re staring at one, remember: You’re not just looking at data. You’re looking at stories, dreams, and the pulse of money in motion.

If you liked this article about financial charts and graphs, you should check out this article about interactive charts.

There are also similar articles discussing creating interactive charts, comparison chart maker, comparison charts, and React chart libraries.

And let’s not forget about articles on javascript chart libraries, chart generator, examples of good graphs, and animated charts.